Understanding LIFO: Last In, First Out Inventory Method

Aug 31, 2025 · Last in, first out (LIFO) is a method used to account for business inventory that records the most recently produced items in a series as the ones that are sold first.

What Is LIFO? The Last-in, First-out Method Explained

Nov 27, 2024 · In this article, I’ll break down how LIFO works, explore its benefits and drawbacks, and show you a comprehensive example of the LIFO inventory method in action.

LIFO (last in, first out): uses and examples - Mecalux.com

Oct 1, 2024 · LIFO (last in, first out) is an inventory management method in which the last item stored is the first to be retrieved. It prioritises the most recently purchased or manufactured batches and …

The LIFO Method Explained: How It Works and When to Apply It ...

Feb 25, 2025 · LIFO is aninventory accounting method where the newest inventory is sold or used first. It’s a straightforward concept but has a big impact on how businesses calculate cost of goods sold …

LIFO Method: Definition and Example - FreshBooks

May 2, 2025 · LIFO, or Last In, First Out, is an inventory valuation method that assumes new goods are sold first. LIFO accounting typically results in a higher cost of goods sold and lower remaining …

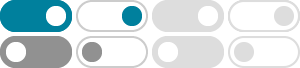

FIFO vs LIFO: Differences & formulas | Sage Advice US

Apr 9, 2025 · LIFO (Last In, First Out) is the opposite of FIFO—it assumes that the newest inventory is sold first, while older stock remains on the books. This method can significantly impact your …

What Is The LIFO Method? Definition & Examples - Forbes

Feb 4, 2025 · While LIFO is an acronym for last -in, first-out, FIFO stands for first -in, first-out. The LIFO method is based on the idea that the most recent products in your inventory will be sold first.

Last-In, First-Out (LIFO): A Comprehensive Guide

What is the LIFO Method? The LIFO (Last-In, First-Out) method is an inventory valuation technique where the most recently acquired inventory items are sold or used first. This means that the newest …

How LIFO Works: A Beginner’s Guide to LIFO » LIFOPro ...

The LIFO Inventory Training Basics & Audit Guide provides detailed LIFO calculation steps, LIFO documentation procedures, internal controls & audit best practices.

Understanding the Last In, First Out (LIFO) Inventory Method

Nov 8, 2025 · Understand the LIFO inventory method and how assuming the last items purchased are sold first impacts financial statements, net income, and tax liabilities.